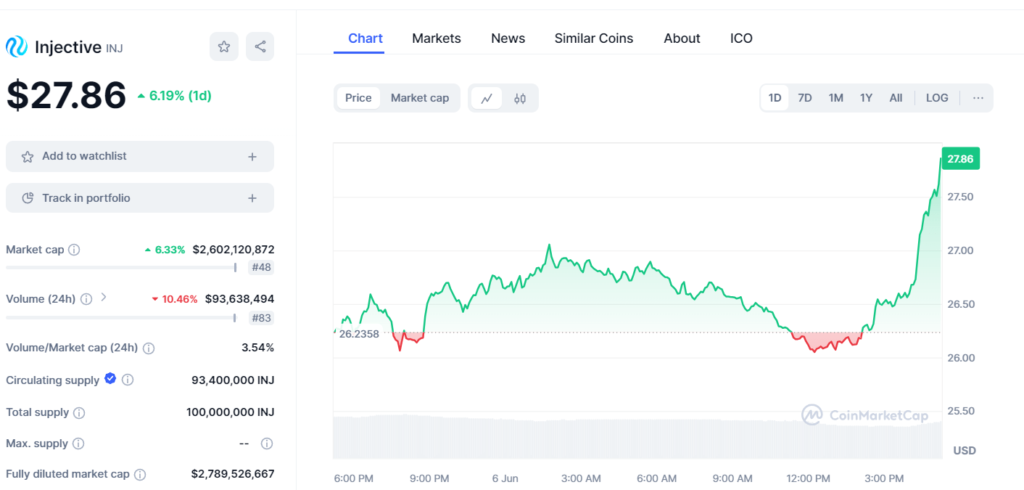

Injective Protocol or Injective (INJ) targets the cryptocurrency market well, and based on the chart, the value of INJ increased by 6. soaring by 33% within one day to trade at $27. 86. This is demonstrated by the fact that investors have been revealing more interest in what is considered by many to be the promising nascent sector that is decentralized finance, abbreviated as DeFi. Currently, the market capitalization is more than $2 for the injective. 6 billion, and it lies among the fifty most demanded cryptocurrencies, so it has undoubtedly found faithful followers on trade and investment grounds.

This is partially true; however, the only rationale behind this unique argument is that Injective offers a specific service that can be valuable in the fledgling DeFi industry. It gives the complete decentralized exchange allowance to the users to explore infinite numbers and types of DeFi markets. Not only does it optimize market finances since it balances the access to the financial markets afforded to everyone but it also enhances the level of authority that an individual has when utilizing such a service since there are no middlemen in this case. This increase in the value could have been due to the better trading facilities it possessed and the constant updates within the network with the aim of attracting more people to the trading platform using easier and cheaper ways.

However, the trading traffic had been reduced by 10 percent and this had an impact on the companies. In other statistics reported in the last 24 Hours, Injective trading continues with a volume of $93 of traded volume. 64 million. This level of activity speaks of an active business atmosphere in evidence of this platform and delivers insight into the comparatively restrained approach taken by this player to the marketing of its services. These trading volumes are signs that there is a lot of interest going on and even though everybody is noticing day-on-day volume reduction in the future the scenario is not very bad.

At the moment, the Initial Disclosed Circulating Supply of INJ, which is the total supply of Injective at the moment, is equal to 100,000,000 INJ; 93% According to sources, there are over 4,000,000 notes that are used in circulation today. This is significant in aiding to control inflation risk but at the same time preserves value in an asset by making its supply limited or scarce. On top of that, they also have the advantage of having no max supply cap for a capped supply in that new tokens can be created at a time that is deemed strategic in expanding the market as well as stabilizing it during periods of volatility.

Some of the important aspects of the platform are; Outstanding shares are calculated to be about 2 billion total worth. 79 billion, denote the total circulating supply market value of Injective should all tokens be in circulation. Altogether, this metric is beneficial for investors because it indicates the prospects of the cryptocurrency market with regard to all the planned supply indicators.

In general, there is a possibility that Injective will have a great future because it is a relatively new platform that may turn(ST) the decentralized trade. This is not only the process of rebuilding of the financial market through the application of the blockchain that has positive consequences such as transparency, security, efficiency, etc, but also the component integration with trends towards sovereignism and diversification.

However, for prospective investors, the risk measurement and management have to be noted to work with cryptocurrencies since the prices of the investments change as the economic conditions, policies, and global sentiments change, More particularly for a platform like Injective. In conclusion, Injective can continue to grow even more by focusing on the next steps of user’s trust by increasing the security level of this platform, developing new products and services, and availing of the general rules of cold assets in digital form.

In this aspect, Injective is illustrative, especially given that it is a DeFi platform that continues to expand while occupying a new position in the contemporary financial market and advancing technologies that define this space.

+ There are no comments

Add yours