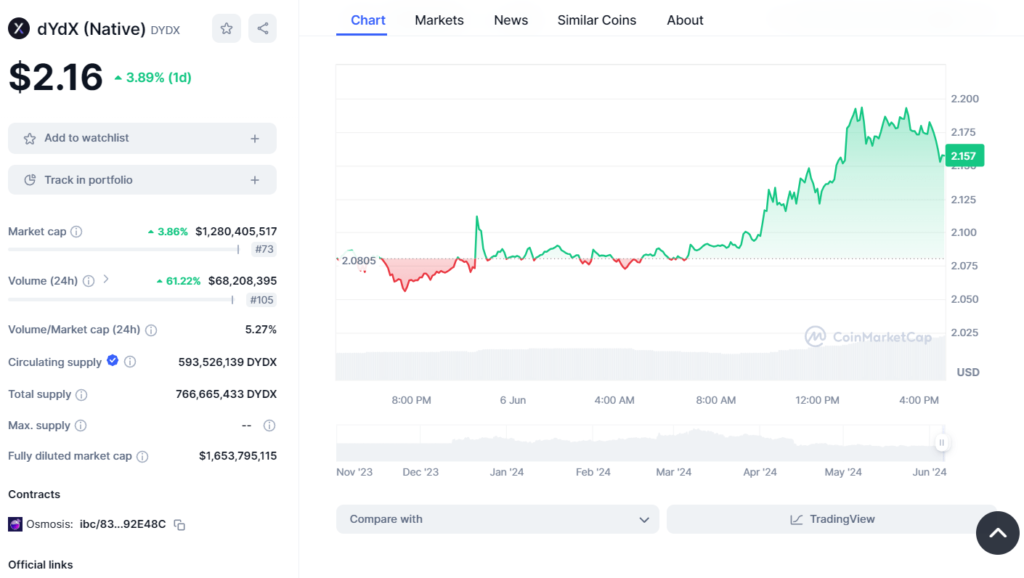

Crypto dYdX and its CYCX related token, DYDX too have seen new highs and its trade in the recent period which surged up to 3. In terms of price, it has dropped by close to 86% within the last day and the current price remains at $2. 16. It has not only had confidence in its investors but also enhanced its Market capitalization to around $1. point), making it stand 73rd globally concerning cryptocurrencies, and with a market capitalization of $28 billion.

dYdX is based on blockchain technology, and it has a focus mainly on the derivatives market. This makes the users able to participate in perpetual contracts and this implies that there is no time limitation to the contracts hence the users can trade many cryptos with wide leverage. In the above graph, it is shown that the price of the platform has gone to by 10, probably because of the high trading volume which has gone up by 61. 22%, reaching nearly $68. In the last day, infections have reached 21 million and above. This points to the fact that volume increases in strength and is busy interacting with dYdX products and services; illustrating demand and belief in this platform’s capacity and capability and ability to deliver a strong proposition in the future.

The emerging market on the other hand is still a youthful one, overall trading volume in relation to market capitalisation stands at a healthy 5. The cost that was fixed for taking many trades at a fast pace made up 27% of the index and revealed a highly active market environment. This is crucial as it assists in the proper conduct of trade in this market and therefore it serves the best interest of both new and veteran. an players. It also addresses the high trading volume and depth to combat bot activity and supports the hypothesis that large fund activities are driving the sizeable market movement in the dYdX token.

In terms of the token’s supply: For the supply side, the total circulating supply of the dYdX token is approximately 593,222,499 tokens. So there are 766 tokens, and 53 million of them were released into the float. 67 million. The Lack of Maximum Supply will enable one to deduce the fact that the Total Supply of new tokens can be issued in the future leading to inflationary pressure that may affect the value of the token. However, the present drive of the availability shows that a greater percentage cut of the total circulation that pervades can go a long way in controlling or curtailing these factors within inflation in the shorter term.

The current VE (Value Locked) is $930,591,086 which represents the total value locked up at DYDX, and the fully diluted market cap reflecting the sum of all DYDX tokens is $1 billion. 65 billion. This makes this metric useful for the potential investor as it enables one to scan the possibility of a future increase in market capitalization with a corresponding increase in the total supply of the tokens.

Concerning future potential, I can identify the following: Some positive prospects for the future trading of dYdX can be attributed to their ability to recognize the decentralized-finance ‘DeFi’ movement, and the increasing trend in the use of derivatives trading in the Crypto market. Self-regulation risks are as follows: Other types of trading will also aid in the simplification of the process of attracting and exploring trading clients something that will be of particular benefit to the dYdX exchange given the increased risks for leverage and derivatives for trading with greater profits. But, as one knows; there is no place like no risks – no threats attached – especially when investing, particularly in such a charged market as the one in issue. They include: Legal constraints as regulators globally shift attention towards DeFi, inherent security risks due to the ubiquitous crypto prerequisites to the technologies employed, and market shocks that may influence derivatives’ demand across a given period.

Thus, using its average stats, dYdX plays a significant role in the DeFi area, and given the current technological factors, it is already having a more and more positive impact on financial dealings through the help of blockchain. It is still constantly growing, with trading volume remaining stable and also the desired market cap increase that would position it among the competitors in the constantly evolving DEX market. First of all, since investors and most of the users of the dYdX platform are currently attracted to receive differential inflows, they will follow the development of the platform’s progress and market conditions in the near future.

+ There are no comments

Add yours