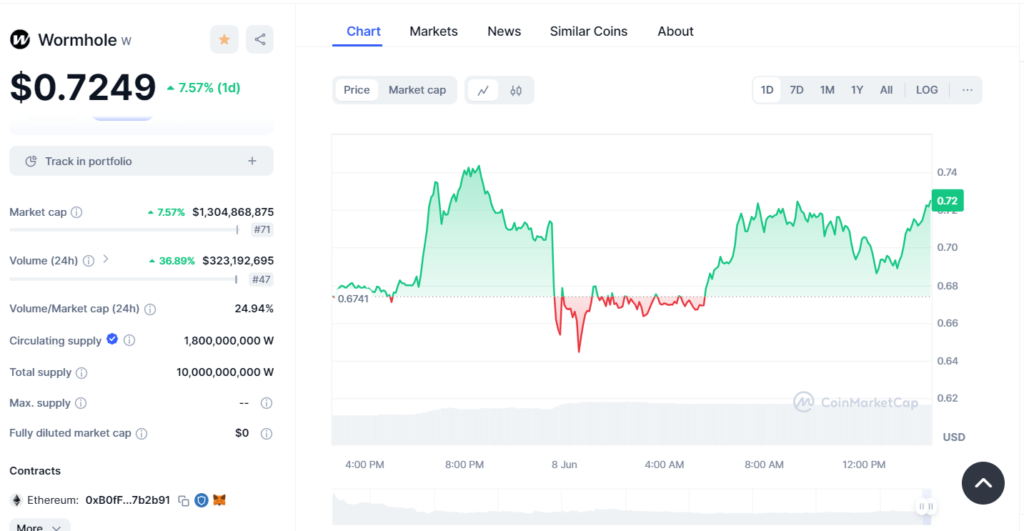

In the fast-paced world of cryptocurrency, Wormhole (symbol: The company’s symbol (W) has recently gained good market momentum and has increased its price by 7%. Rather in a single day increased by 57% and got to $0. 7249. Some of the factors contributing to this include an increase in Moderna’s market capitalization to approximately $1. 3 billion, occupying a seventy-first place among the digital currencies available on the market.

Wormhole trading has increased to 36% this year with more trades resulting in the usage of Wormhole. over a 24-hour period with a total turnover reaching almost $323 with an 89% turnover rate. 19 million traded. Hence, we may see investors are more active and trading frequently with Wormhole which points towards the sound trading signals and the fact that the revenue is increasing that may signify that investors are holding more WMX or they are both buying the currency in bulk for the benefit or selling them after their prices have gone up as seen in this trading cycle.

Other fundamental ratios like volume to market cap ratio for Wormhole is an enticing 24. Practicality had an approval rating of 94%, and this is quite high. This ratio is among the most important in the crypto analyzing area which describes a high percentage of the general market cap that is offered within a single day. A figure like this usually is an indicator of high activity in terms of trading and can also be a sign that a certain big news piece or a shift in overall market sentiment is affecting the trading of the token.

For the Wormhole, the circulating supply has been established at 1. TOKEN DISTRIBUTION In order to incentivize the adoption of the token in the market the following distribution will be implemented Total tokens initially minted 10 billion with the ERC-20 token claiming 8 billion. , the fact that there is a large difference between the circulating supply and the total supply means that there could still be many more tokens that could make their way to the active circulating supply which could in a sense dilute the value. Conversely, the elimination of the maximum supply cap could also bring some sort of weight for the managing entity to adjust to the market call or adopt these reserves depending on the staking, burning, or other mechanism to achieve control over supply.

While the fully diluted market has numerous peculiarities, it is still quite shocking to see that it has zero value despite the promising surge and the solid trading volume. It could be a reporting issue where the numbers/price entered into the wrong bucket or a relative blip/trend in the market that might have to be clarified with data sources or the token/emissions issuers. Further research is needed regarding this aspect since it may influence the perception of investors and the further action in the market of Wormhole.

Wormhole may attract the attention of investors and market observers as of recently based on the results and as an entry to various applications if it is yet to make a breakthrough in. The market for cryptocurrencies is especially sensitive to the tokens that are presented as offering solutions that are not available by means of any other technology or their improved offers. As noted above, the main industry in which the Wormhole might establish itself is the real estate industry as well as other niche segments that may remain loyal to this token if it targets niche markets more proactively or develops unique features that would be useful to these specific segments.

But everyone is advised to be careful, especially the potential investors. Cryptocurrencies are highly specific when it comes to trading fluctuations; fast and dynamic profits can be as fast and dynamic as invented. Market participants should also ensure due diligence and assess the total risk management view and the investment horizon of an investment fund before making an investment decision. There are determinants that flank the macro-economic environment, policy shifts, technological advancements, and competition, which all have a significant influence over potential gains or losses in the investment in a cryptocurrency.

Thus, by evaluating Wormhole today, we may get an idea of its contemporary state and possible success on the market. In management, trading volume and market capitalization demonstrate bullish fundamentals while like every other cryptocurrency, it is inbound for several risks and this ambiguity. A specific factor that investors should consider is whether Wormhole is adapting well to market conditions and whether it is able to continue to sustain its growth in light of the ever-fluid world within the sector.

+ There are no comments

Add yours