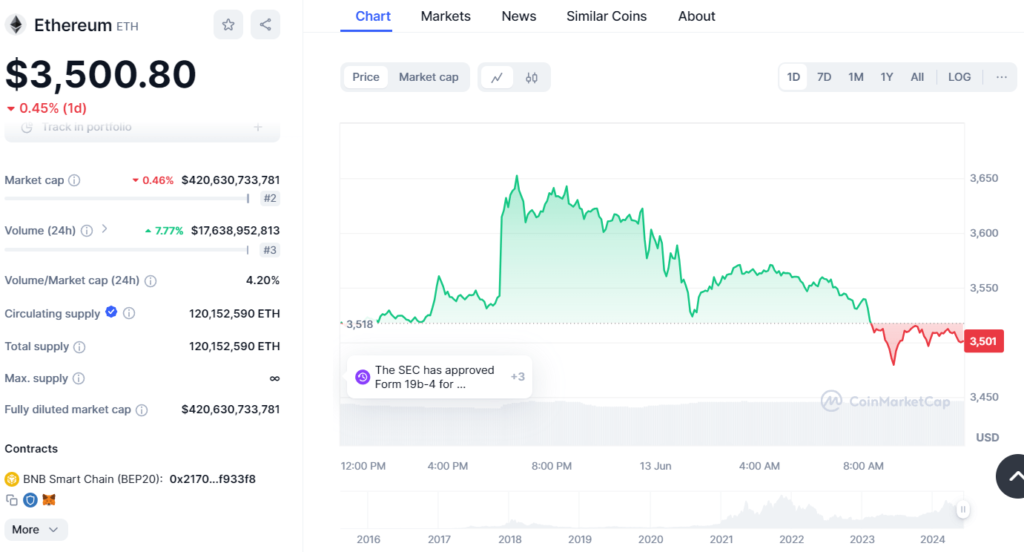

In the dynamic world of cryptocurrencies, Ethereum remains a focal point for investors and technologists alike. Recently, Ethereum’s trading price has been a topic of considerable discussion, with its value hovering around $3,500.80 as of the latest update. Despite a modest day-on-day decline of 0.45%, Ethereum has shown significant resilience in the broader financial landscape, which has been marked by rapid shifts and a certain degree of uncertainty.

Currently, Ethereum boasts a market capitalization of approximately $420.63 billion, securing its position as the second-largest cryptocurrency by market cap. This slight decrease of 0.46% in market cap does little to overshadow its prominence in the crypto space. Over the past 24 hours, Ethereum has seen a notable increase in trading volume by 7.77%, totaling around $17.64 billion. This increase in volume, relative to its market cap, which stands at 4.20%, underscores a heightened investor interest and trading activity.

The total and circulating supply of Ethereum tokens remains steady at 120,152,590 ETH, with no hard cap on the maximum supply, suggesting potential for infinite issuance. This aspect of Ethereum’s monetary policy continues to be a subject of debate among investors who prefer a more deflationary model.

Looking at the price chart, Ethereum experienced a significant surge, reaching new heights before encountering resistance that led to a subsequent decline. This volatility is not uncommon in the crypto markets and often reflects broader economic sentiments and market dynamics. Ethereum’s recent price actions suggest testing of key support and resistance levels, with the price currently near a crucial juncture that could determine its short-term trajectory.

The recent price action in Ethereum also corresponds with various macroeconomic factors and developments within the blockchain sector. For instance, regulatory news such as the SEC’s movements regarding crypto can have substantial impacts on market prices. Ethereum’s network also continuously evolves, with upgrades that aim to improve scalability, security, and sustainability, which can significantly affect investor sentiment and market dynamics.

For long-term investors, the current market conditions present a complex landscape that requires careful analysis of both on-chain metrics and broader economic indicators. Ethereum’s robust community, ongoing development, and position within the broader ecosystem of decentralized applications (dApps) provide strong fundamentals. However, as with any investment, potential risks stemming from regulatory changes, market volatility, and technological challenges must be carefully considered.

In conclusion, Ethereum continues to navigate through fluctuating market conditions with a mix of resilience and vulnerability. As the blockchain industry progresses towards more widespread adoption and integration into mainstream finance, Ethereum is likely to remain at the forefront of this transformative movement. Investors and market watchers will undoubtedly keep a close eye on Ethereum’s technical indicators and market movements to gauge its future in the ever-evolving cryptocurrency landscape.

+ There are no comments

Add yours