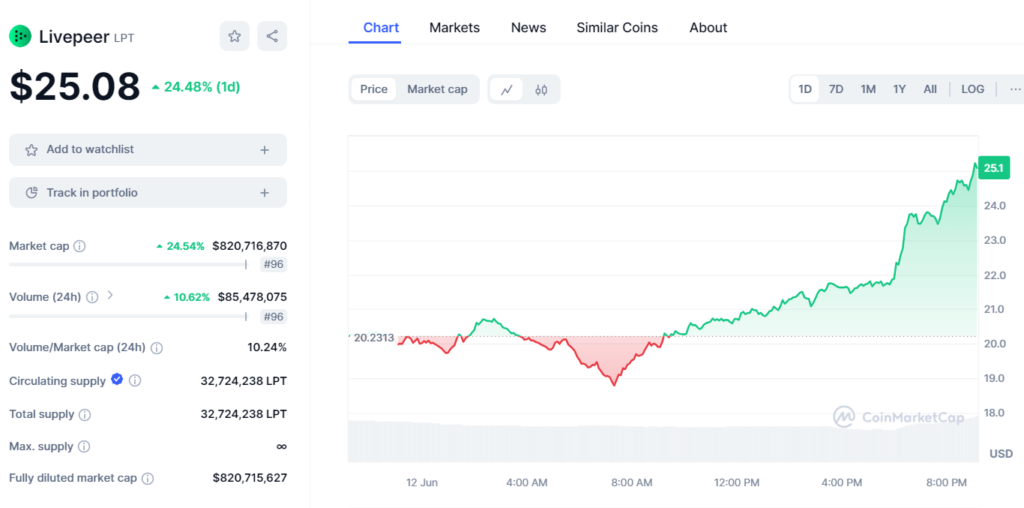

This new social video streaming company, Livepeer (LPT), a decentralized video streaming platform operating on the Ethereum network, has recently emerged as one of the most popular digital tokens in the market and it has risen by 24%. 48% within a twenty-four period to the $25. 08. As can be seen, this increased the market capitalization of Livepeer to about $820, which is significantly higher than its preconized price. US$ 7 million with a ranking of 96 making it one of the world’s leading cryptocurrencies. Nevertheless, this article aims to discuss the reasons for such rapid growth and what this may guarantee for the future of LPT.

This particular price spike is notable not only for its size but for the trading volume it was able to garner in the process. With a 10. 51% rise in the 24-hour trading volume, which amounted to approximately $85. 5 million, as shown above, Livepeer has a healthy trading typical of active platforms. Such levels of activity are truly notable, especially in view of recent fluctuation in the overall crypto market and they cannot but evidence the growing interest of investors in the prospects and functioning of decentralized platforms for content distribution.

Central to this writing is the volume to market capitalization, VOL/MKT CAP, which actually stands at a rather strong 10 for Livepeer. 24%. Looking at this ratio we get an idea of the kind of activity there is within the market and the overall liking of Livepeer out of the total value of its tokens that can be traced in the active trading. As for high liquidity, it can be interpreted as the existence of a healthy market that can attract more investors because of the availability of easily accessible entry and exit points.

There are also several things to look at in terms of LPT supply specifics. For circulating supply, this is fixed at 32,724,238 LPT with no new coins out there to be created. This fixed supply could also lead to a scarcity situation which in turn could put up the price if the demand shoots up. Moreover, this means that the lack of a mechanism with a maximum supply cap opens up the potential for further changes within the protocol, meaning that new supply/demand dynamics can be introduced.

Markets, which could be a reason that led to the dramatic increase in Livepeer’s price, can be explained by several factors. As for the concept, Livepeer is a project that strives to lower the expenses of delivering videos via the Internet in comparison with normal or conventional video-hosting services since users are to share their otherwise unused computing resources, like processing abilities and bandwidth to encode and distribute the videos. The platform’s adventitious idea of solving a real-world issue, which is the enhancement of video broadcasting through the blockchain technique, may have shaped its growing appeal to potential investors who are interested in projects with tangible applicability solutions as well as high commercially scalable prospects.

Furthermore, the trend toward investors’ interest in CRYPO in general, new interest in decentralized applications (dApps), as well as the ongoing expansion of the Ethereum network, may also contribute to the stabilization and strengthening of LPT positions. As blockchain and its associated technologies remain established and more use cases are introduced, highly specialized applications such as Livepeer are primed to receive additional consideration.

In conclusion, the mentioned price trend of Livepeer indicates that decentralized technologies have the capability to disrupt various industries including video streaming. From investors’ and market analysts’ perspectives, the maintenance of such write-ups might prove useful in helping to draw as to which direction the market might be headed and towards which sectors it might be headed next.

+ There are no comments

Add yours