In the constantly changing market of cryptocurrencies, many stay for a short time, while others disappear altogether; However, Monero (XMR) still continues to intrigue users not only with anonymity but also with the recent record changes in the market. Paying detailed attention from the perspective of a cryptocurrency analyst is full of valuable insights about the token and the market.

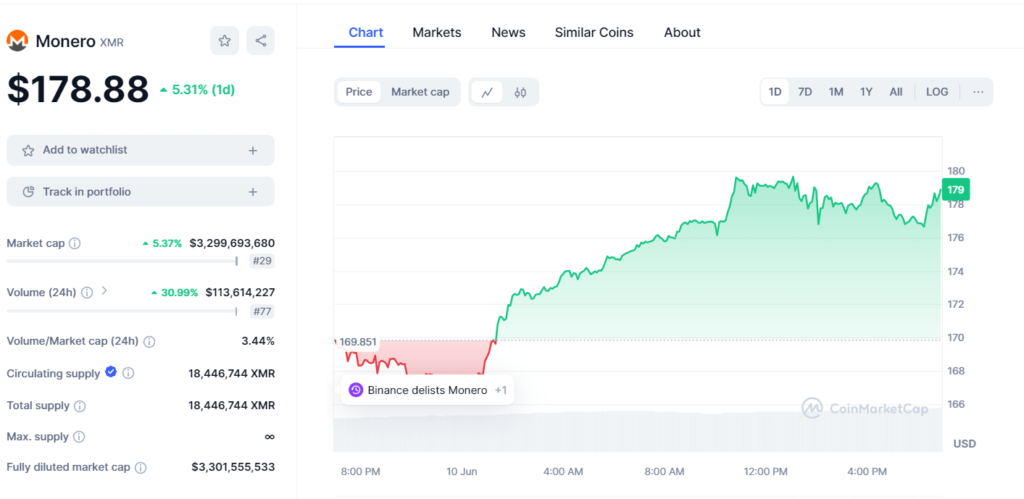

One of those is Monero which provides very powerful protections of anonymity that hide sender and receiver data along with the amount of the operation; this cryptocurrency gained a boost in price to $178. 88. This represents a 5. From 307 to 421 – an increase of 37% within a day. Since privacy plays an essential role in crypto, its importance increases Moneros usability assuming that its average daily trading volume is more than 113 million USD in the last 24 hours only.

On the same note, there was a rise in total market capitalization, a pointer to the total market value of all the coins in circulation: 5% in Monero. 14% to approximately $3. 3 billion. This puts Monero in the 29th position in the global cryptocurrency Market capitalization list. These types of metrics are essential for individuals as analysts who determine the state and future of various digital resources.

One thing about Monero that can be said is that they have different supply measurements. It also has something in common with other cryptocurrencies, that is there is no cap on its total supply meaning it can be mined without limit. Agnostic mining incentives are also designed in such a way that long-term miners don’t lose their incentives over time making the network more decentralized. But it also opens possibilities for inflation that analysts do not ignore, especially when mentioning the experience of developed countries.

That took the ratio of total trading volume in a given day to the market capitalization of the index’s constituents to 3. 44%, proving the fairly active trading activity when compared to a market size. This ratio is a very significant one when analysts are searching for the consistency of the asset, specifically a high ratio that means a high volume of trading which is very important when investigating on the simplicity of the value change of a security within a short span.

However, one of the significant occurrences in Monero’s history was the. remove from Binance – one of the largest cryptocurrency trading platforms worldwide. It could be a major factor that would have multiple repercussions. At the same time, it can limit the expansion of the token entry point to a wider base of investors, which can drag the rate down, although it also emphasizes the further bureaucratic problems with the anonymity of tokens. Experts would evaluate such delistings in terms of their effect on investor confidence and market perception of Monero among potential investors.

Investors and traders rely on cryptocurrency analysts such as the ones specializing in Monero to interpret these rich and multifaceted signals that they relay in order to guide investments and tradings. What they offer are numerical approximations and measures, for instance, market cap assessments and volume fluctuations intermingled with qualitative data and information, including regulatory outputs and advances in technology. Reasons have their analyses that assist in providing a broader understanding of the potentialities of various threats and opportunities related to investing in such cryptocurrencies as Monero.

All in all, Monero is another example of how the market outlook and difficulties encountered in the field can be turbulent yet interesting, at least in the given period of time. While investors are expected to navigate the market and make their investments, analysts help them in understanding these movements and the investment process. The ideas they provide are good not only because they can give clues for today’s trading but also for the change happening gradually in the new generation of the electronic currency market.

+ There are no comments

Add yours